deferred sales trust example

Edit Sign and Save Irrevocable Trust Agreement Form. Ad Create a Living Trust to Seamlessly Transfer Your Property or Assets to a Beneficiary.

Senior Citizen Real Estate Tax Deferral Program Cook County Assessor S Office

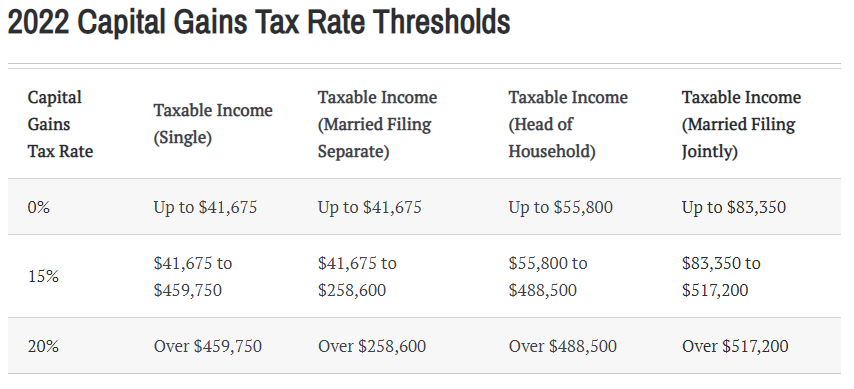

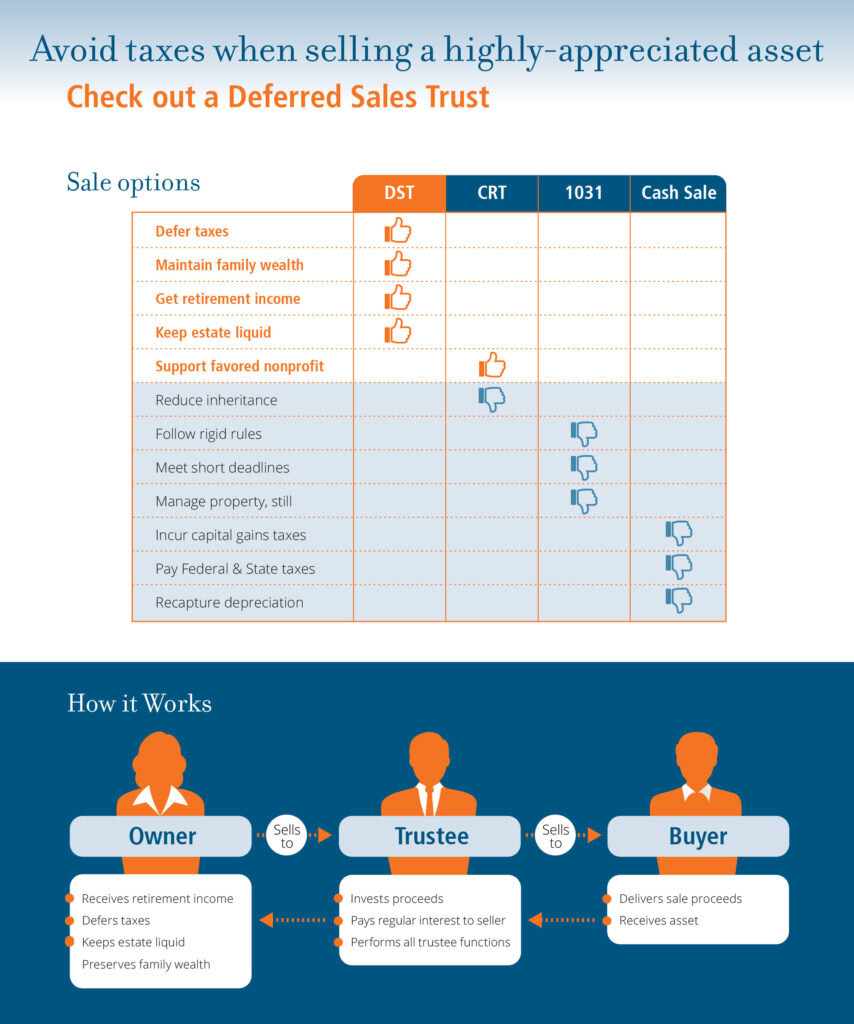

In the above example there would be no taxes due with a Deferred Sales Trust.

. You may be interested to hear the experiences of other business and property owners who have sold their assets to the deferred sales trust. A deferred sales trust DST allows for the deferral of capital gains tax when selling real estate or other qualified assets. Web-based PDF Form Filler.

The Deferred Sales Trust is not new nor is it an untested structure. Send any friend a story. The deferred sales trust is the replacement for the private annuity trust.

Here is another example of a couple in California selling a highly appreciated residential property in California. TimesMachine is an exclusive benefit for home delivery and digital subscribers. Similar to an IRA with a Deferred Sales Trust you also defer paying taxes on the profit of a real estate or business sale as long as the profits are invested by the DST rather than the seller.

Anyone can read what you share. The same structure was written about in 1986 by the Harvard Law Review stating This is an example of the time value. Discover The Answers You Need Here.

Steve employs a deferred sales trust to sell his 19 million property. Deferred Sales Trust Case Studies. Full text is.

As a subscriber you have 10 gift articles to give each month. Whereas 1031 exchange is relegated solely to real estate deferred sales trusts can take the money investors make on the sale of a real estate asset and allocate it towards other asset. Choosing a deferred sales trust was easy for Peter since he was tired of the 1031 exchangeIt turned out to be about the same monthly income minus most of t.

Ad Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms. Save Time and Money by Creating and Downloading Any Legally Binding Agreement in Minutes. Ad Register and Subscribe Now to work on Irrevocable Trust Agreement more fillable forms.

As in a private annuity trust title is transferred to the trustee who then sells the property and puts the. Capital Gains Tax Solutions. Ad Access Portfolio Management Consulting Opportunities at Bank of America Private Bank.

Today Ill discuss a deferred sales trust scenario. Give this article Give this article Give this. As a subscriber you have 10 gift articles to give each month.

Get Access to the Largest Online Library of Legal Forms for Any State. Anyone can read what you share. Summary Changes in Internal Revenue.

Change in Accounting for Deferred Compensation Plans If you have questions please call Municipal Accounting Systems at 518 474-6023. Rather than a typical transaction where the seller would receive funds.

Deferred Sales Trust The 1031 Exchange Alternative Debt Free Dr Dentaltown

The Tale Of Two Dst S Delaware Statutory Trust Vs Deferred Sales Trust Reef Point Llc

How To Eliminating Capital Gains Tax Using A Spendthrift Trust

Deferred Sales Trusts How Do They Work Cohan Pllc

4 Risks To Consider Before Creating A Deferred Sales Trust Reef Point Llc

![]()

Next Steps Capital Gains Tax Solutions

Deferred Sales Trust Vs 1031 Exchange Youtube

Advisor Ink Financial My Wealth And Tax Team

Deferred Sales Trust Capital Gains Deferral

Application For Inactive Real Estate Sales Agent License Trec

Charitable Remainder Trust Guide Learn With Valur

Deferred Sales Trust The 1031 Exchange Alternative

Sell Your Business With Maximum Gains Via Deferred Sales Trust With Brett Swarts Seiler Tucker

Why You Should Consider Using The Deferred Sales Trust More Than Ever

Deferred Sales Trust Introduction Jrw Investments

Deferred Sales Trust O Connell Investment And Insurance Services

Southern California Home Owner Says A Deferred Sales Trust Unlocked A Clear Path To Sell My Home Capital Gains Tax Solutions

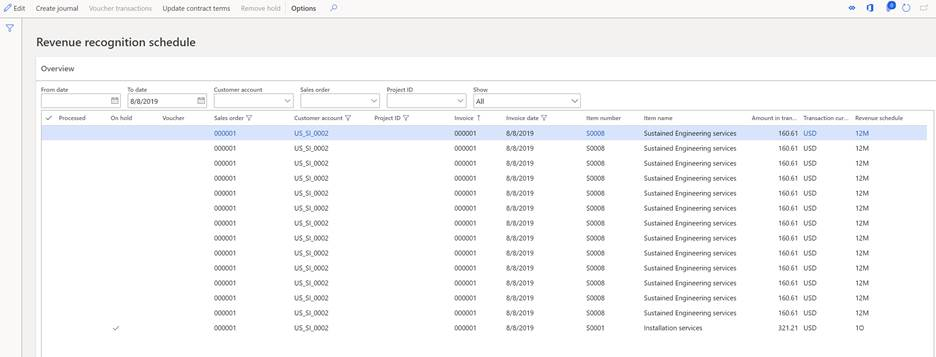

Recognize Deferred Revenue Finance Dynamics 365 Microsoft Learn