puerto rico tax incentives 2021

Purpose of Puerto Rico Incentives Code Act 60. Puerto Rico offers a 30 tax deduction up to 1500 for expenses incurred in the purchase and installation of solar equipment to heat water for residential use.

Tax Incentives Is Relocating To Puerto Rico The Right Move For You

Alongside Democratic Reps.

. Still Puerto Rico hopes to lure American mainlanders with an income tax. Most recently then Governor of Puerto Rico Ricardo Rossello signed Act 60-2019 Incentives Act into law on July 1 2019 with an effective date of January 1 2020. In addition to Act 20 Puerto Rico also passed Act 22 known as the Individual Investors Act so as to attract wealthy individual investors to relocate to the Island.

Legacy Act 20 generally provides for a 4 tax rate on income from specified export activity. The Puerto Rican government is luring businesses and investors to their beautiful island with attractive tax incentives like a 4 corporate tax rate and a 0 tax rate on capital gains. The Incentives in a Nutshell.

Act 60 consolidated various tax decrees incentives subsidies and benefits including Acts 20 and 22. 28 May 2021. 19 2019 letter to Treasury Sec.

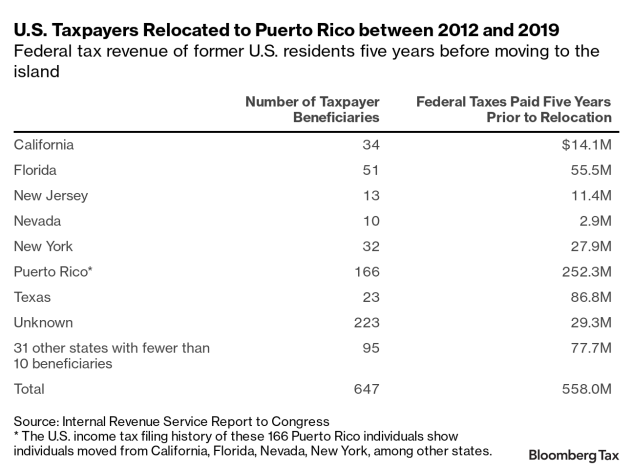

Acts 20 and 22 were intended to incentivize investment in Puerto Rico promote the exportation of services. Steven Mnuchin demanding greater oversight into and more information about the Puerto Rico tax incentives that are resulting in US. To promote the necessary conditions to attract investment from industries support small and medium merchants face challenges in medical care and education simplify processes optimize and provide greater transparency Act 60-2019 was signed which establishes the new Puerto Rico Incentive Code.

Posted on June 16 2021 by admin. The mandatory annual donation to Puerto Rican charity increased from 5000 to 10000. Puerto Rico finally did pass its own EITC last year but it lacks.

One of the most well-known Puerto Rican tax incentives the Individual Resident Investor tax incentive is available to any person who was not a resident of Puerto Rico for the 10 tax years preceding July 1 2019 and who becomes a resident before December 1 2035. Benefits of establishing relocating or expanding businesses in Puerto Rico. Puerto Ricos Incentives Code 4 fixed income tax on eligible income 0 tax on Capital Gains Dividends Interest Crypto Gains1 Up to 50 back in tradeable tax credits on RD.

27 2021 the Internal Revenue Service IRS announced a new compliance campaign focusing on the Puerto Rico Act 22 now Act 60. Puerto Rico also has sky-high poverty rates but its poorest residents cant participate in the Earned Income Tax Credit EITC. Lets explore the tax implications pitfall and tripwires for US individuals to be aware of before relocating to Puerto Rico.

Benefits of the incentives Strengthening the compliance with and the auditing of the incentives Improving Puerto Ricos economic competitiveness Act 60. Chapter 2 of the Incentives Act includes measures to attract individual investors to Puerto Rico by providing many incentives to resident individuals such as full tax exemptions on Puerto Rican-source. The purpose of this Act is to provide incentives to individuals who have not been residents of Puerto Rico to become residents.

Many sizable tax breaks like these are offered across a variety of industries making Puerto Rico Americas last true tax haven. Puerto Rico Tax Incentives. The law has enabled high-income individuals and profitable service.

Puerto Rico decided to double down on tax incentives in 2019 with a new law making the island even more appealing for new businesses and investors. Solar equipment is defined as any equipment capable of using solar energy directly or indirectly to heat water whether such equipment is bought or manufactured by the taxpayer provided that the same is operating. As provided by Act 60.

The tax laws known as Act 20 the Export Services Act and Act 22 the Individual Investors Act shields new residents residing in Puerto Rico for at least half of the. The purpose of Puerto Rico Incentives Code 60 is to promote investment in Puerto Rico by providing investment residents with tax breaks. The purpose of Act 60 is to promote investment in Puerto Rico by providing investment residents with tax breaks.

Under Act 22 bona fide residents of Puerto Rico who qualify can completely eliminate capital gains tax with a 100 tax exemption on assets acquired after the applicant has. In January of 2012 Puerto Rico passed legislation making it a tax haven for US. If youre looking for a strong return on your investment you need to understand the details of Act 20 and Act 22 Puerto Rico tax incentives for business and individual investorsIn a recent attempt to strengthen its economy and attract investors the local government has stepped up its economic and tax incentives for those wanting to do business here.

Consider moving to the island in 2021 to take advantage of the income and capital gains tax benefits before Bidens tax plan comes into effect. Income from personal services performed within Puerto Rico will not be considered from Puerto Rican sources if it is 3000 United States dollars USD or less and the individual was present in Puerto Rico for 90 days or less. A bona-fide resident of Puerto Rico can avoid including all or part of the income or dividends from the company in US.

Citizens that become residents of Puerto Rico. In order to encourage the transfer of such individuals to Puerto Rico the Act exempts from Puerto Rico income tax their passive income which may consists of interest dividends and capital gains. Through this regulation provisions for Act 60 of 2019 known as the Puerto Rico Incentives Code went into effect with the purpose of establishing the norms requirements and criteria to be used in the.

Puerto Rico has a de minimis rule to avoid sourcing to Puerto Rico very small amounts of income from personal services. José Serrano Nydia Velázquez and Raúl Grijalva Ocasio-Cortez signed a Dec. Authored by Manny Muriel.

Then in April the Governor signed new legislation which raised the annual filing fee for Act 22 from 300 to 5000. Puerto Rico offers the security and stability of operating in a US jurisdiction with an array of special tax incentives for foreign direct investment that can be found nowhere else in the world. Puerto Rico offers tax incentives packages which can prove attractive to US mainland.

In many if not most cases you must file taxes in two places with the IRS and with the Puerto Rico Department of Finance. And within the first two years of living there you now need to buy a home in Puerto Rico. To be eligible investors must donate 10000 to nonprofit entities in Puerto Rico.

Investors and businesses have already moved to Puerto Rico to take advantage of the islands gorgeous weather low prices and vibrant Hispanic culture in addition to its tax benefits.

Guide To Income Tax In Puerto Rico

Open A Corporate Account In Puerto Rico Remotely Internationalwealth Info

Puerto Rico S Challenges Present An Opportunity For Tax Reform Foundation National Taxpayers Union

Should You Be Moving To Puerto Rico To Save Tax Global Expat Advisors

Irs Seizes Foothold On Puerto Rico Tax Haven Audits

Puerto Rico Tax Incentives Defending Act 60 Youtube

Could Puerto Rico Be Your Crypto Tax Haven Gordon Law Group

New Puerto Rico Tax Incentives Code Act 60 Explained 20 22

Crypto Rich Are Moving To Puerto Rico World S New Luxury Tax Haven Bloomberg

![]()

Taxation Puerto Rico Move To Puerto Rico And Pay No Capital Gains Tax

Puerto Rico Tax Incentives Puerto Rico Luxury In 2021 Puerto Rico Architecture Places To Visit

Us Tax Filing And Advantages For Americans Living In Puerto Rico

Puerto Rico Taxes How To Benefit From Incredible Tax Incentives Global Expat Advisors

Looking Back On Fiscal 2018 As Puerto Rico Starts A New Fiscal Year Council On Foreign Relations

Puerto Rico Tax Haven Is Alluring But Are There Tax Risks

Moving To Puerto Rico Your Easy Escape To Caribbean Life

Guide To Income Tax In Puerto Rico